AIRPORT WAY & COLUMBIA CORRIDOR

INDUSTRIAL REAL ESTATE - PORTLAND, OR

Airport Way and the Columbia Corridor are among the Portland metro’s most searched industrial areas due to proximity to PDX, I-84, I-205, and major freight routes. The corridor includes a broad mix of distribution facilities, functional older warehouses, contractor service space, and flex/industrial buildings. This page outlines what typically fits here, how to evaluate options, and the deal terms that most affect total occupancy cost.

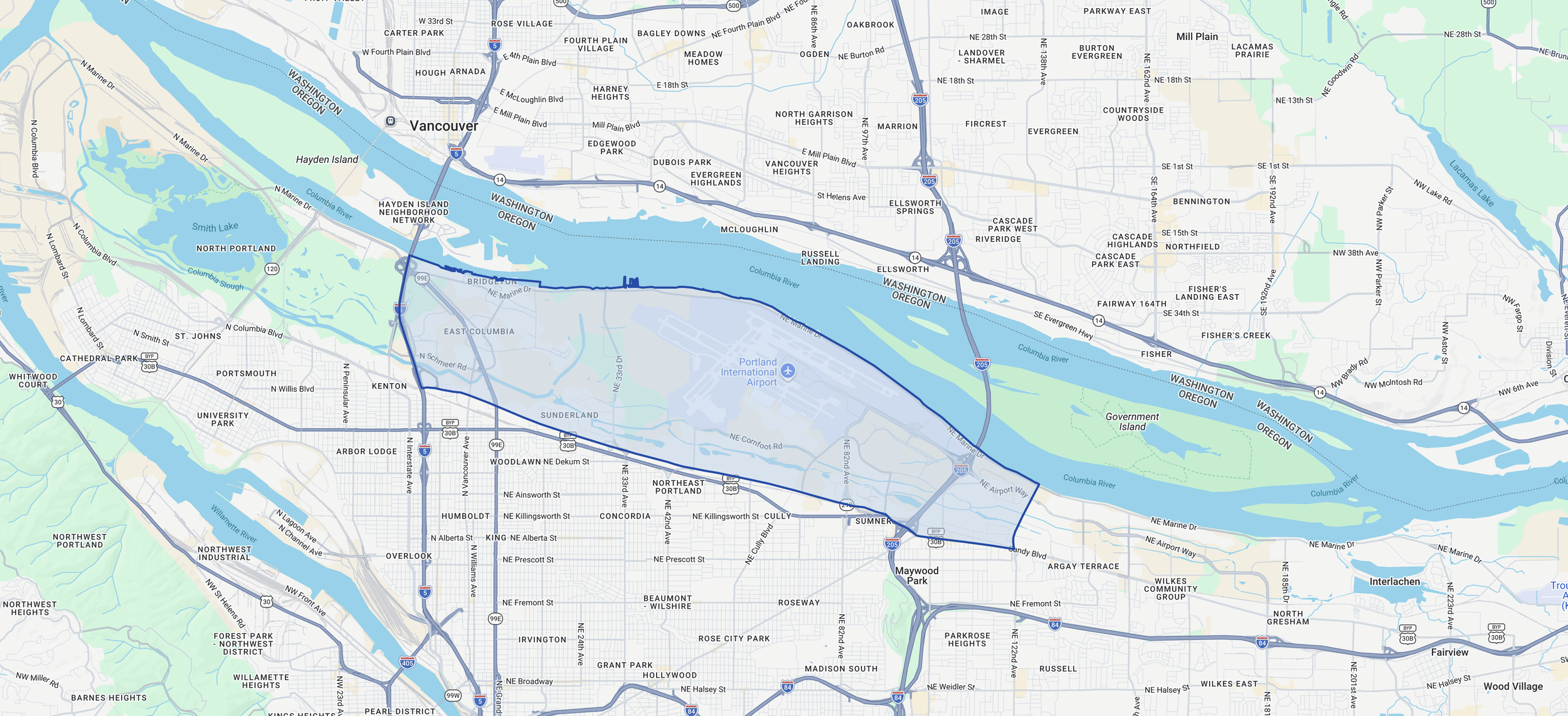

Airport Way & Columbia Corridor generally refers to the industrial area in Northeast Portland centered around NE Airport Way and NE Columbia Blvd, anchored by proximity to Portland International Airport. It runs through the broader I-84 and I-205 industrial belt, with quick access to major freight routes and distribution nodes. Boundaries can vary by listing, but the practical focus is the cluster of warehouse, distribution, and flex/industrial inventory serving PDX and eastside freeway connectivity.

QUICK SNAPSHOT

Known For

Strong regional access (I-84 / I-205) and airport adjacency

Distribution and logistics demand, plus service/contractor and light industrial users

A wide spread of building ages/specs—from functional to modern

Typical User Profiles

3PL and logistics, last-mile distribution

Contractors and service fleets

Light manufacturing / assembly (where power and zoning fit)

Best Fits

Distribution with frequent inbound/outbound movements

Users needing a balance of warehouse + office

Contractor/service operations prioritizing access and response time

Common Constraints

Trailer parking and yard availability can be limited in tighter sites

Loading configuration varies widely (dock vs grade; door count; truck courts)

Utility/power and sprinkler adequacy can be deal-critical depending on use

RENT, PRICING, AND DEAL TERMS

Asking rent is influenced by building spec, loading, location within the corridor, site utility (yard), and overall functionality/condition. Concessions and expense structure often change effective economics more than the headline rate.

Negotiation Levers That Matter

Concessions: free rent, TI/turnkey packages (especially for office-heavy builds)

NNN/CAM language: inclusions/exclusions, management fees, capital items, reserves

Caps and audit rights: especially on controllable expenses

Options: renewal, expansion, early termination (when justified)

Maintenance responsibilities: clarify roof/structure/HVAC allocations and standards

How Proposals Should Compare

Compare total occupancy cost using effective economics: base rent + operating expenses + concessions amortized over term + tenant costs (improvements, moving, downtime). Two “similar” deals can price very differently once CAM definitions and concessions are normalized.

SUBMARKET FAQ

-

Often 12–18 months prior to expiration, earlier for specialized uses or meaningful improvements.

-

It’s a common first stop for distribution due to access and inventory mix, but the best fit depends on lanes, labor, and trailer/yard needs.

-

Beyond dock vs grade, door count, truck court depth, circulation, and site constraints often determine operational fit.

-

Confirm what’s included/excluded, base-year vs NNN structure, management/admin fees, capital treatment, caps on controllables, and audit rights.

-

Whether the yard is exclusive, permitted use (storage/trailers), fencing/security obligations, and whether it’s included in rent or separately priced.

-

Power availability and upgrade feasibility, ventilation/HVAC needs, layout/column spacing, slab condition, and loading that matches workflow.

-

Unverified power/sprinkler needs, unclear maintenance responsibilities, CAM language surprises, or site constraints discovered after the LOI.

RELATED

GET IN TOUCH

Contact Matt Lyman at Norris & Stevens about any Portland commercial real estate need—leasing, renewals, relocations, site selection, lease-up strategy, tenant/landlord representation, acquisitions, dispositions, or a quick market opinion.

Share your property type, size, location/submarket, timing, and what decision you’re trying to make, and Matt will follow up with clear next steps and relevant market context.

Coverage includes industrial, office, retail, and flex across the Portland metro—217 Corridor (Beaverton/Tigard/Tualatin), Central Eastside, Airport Way/Columbia Corridor, Clackamas, and Vancouver, WA.