Portland Industrial Submarkets

A practical guide to the major industrial corridors—what each area is best for, and how to choose.

Portland’s industrial market is not one market—it’s a set of corridors with different building stock, access, zoning realities, and lease economics. This page provides a fast overview of the key Portland industrial submarkets and what typically fits where, then links to deeper guides for each area. Coverage focuses on warehouse, distribution, manufacturing, and flex/industrial users across the Portland metro and nearby Southwest Washington.

SUBMARKETS

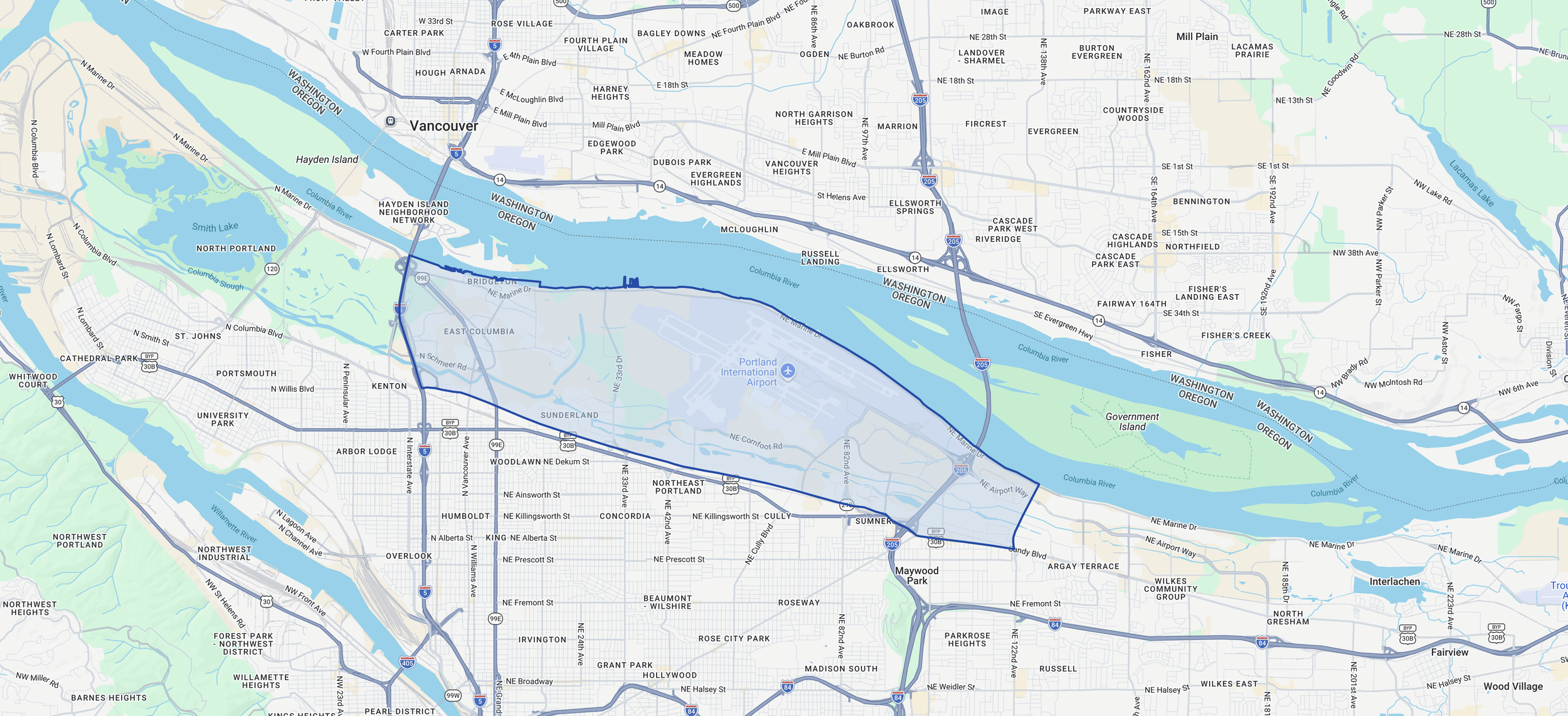

AIRPORT WAY & COLUMBIA CORRIDOR

One of Portland’s most active industrial corridors, anchored by PDX access and strong I-84/I-205 connectivity. Inventory ranges from modern distribution to functional warehouses and flex/industrial with wide variance in loading, yard, and power.

Best for: distribution/3PL, last-mile, and users prioritizing freeway and airport access.

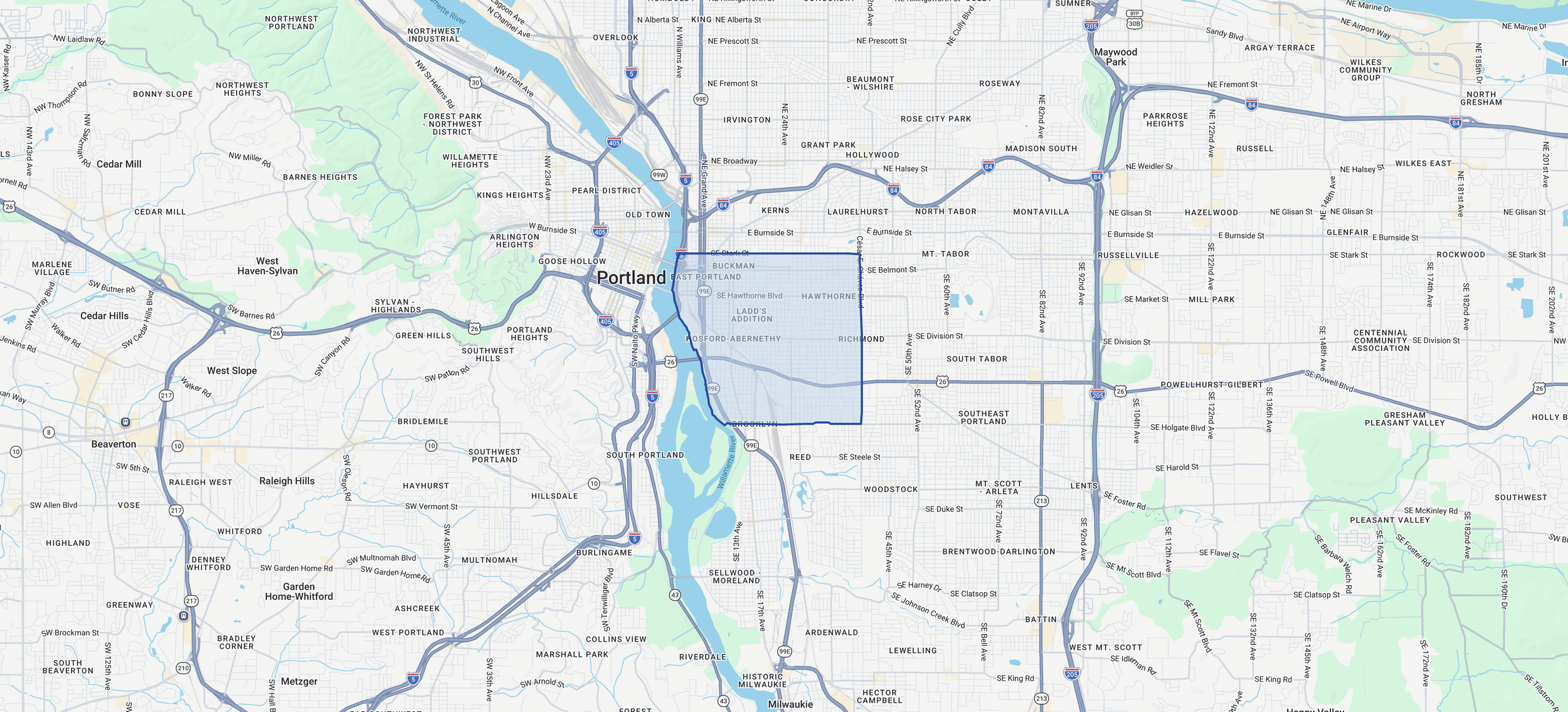

CENTRAL EAST SIDE & INNER SOUTH EAST

Close-in industrial and flex where central access and mixed-use functionality often matter as much as pure warehouse specs. Expect tighter sites, fewer yard options, and more emphasis on parking, zoning fit, and building layout.

Best for: light production, showroom/flex, maker space, and service users needing close-in proximity.

Explore More →

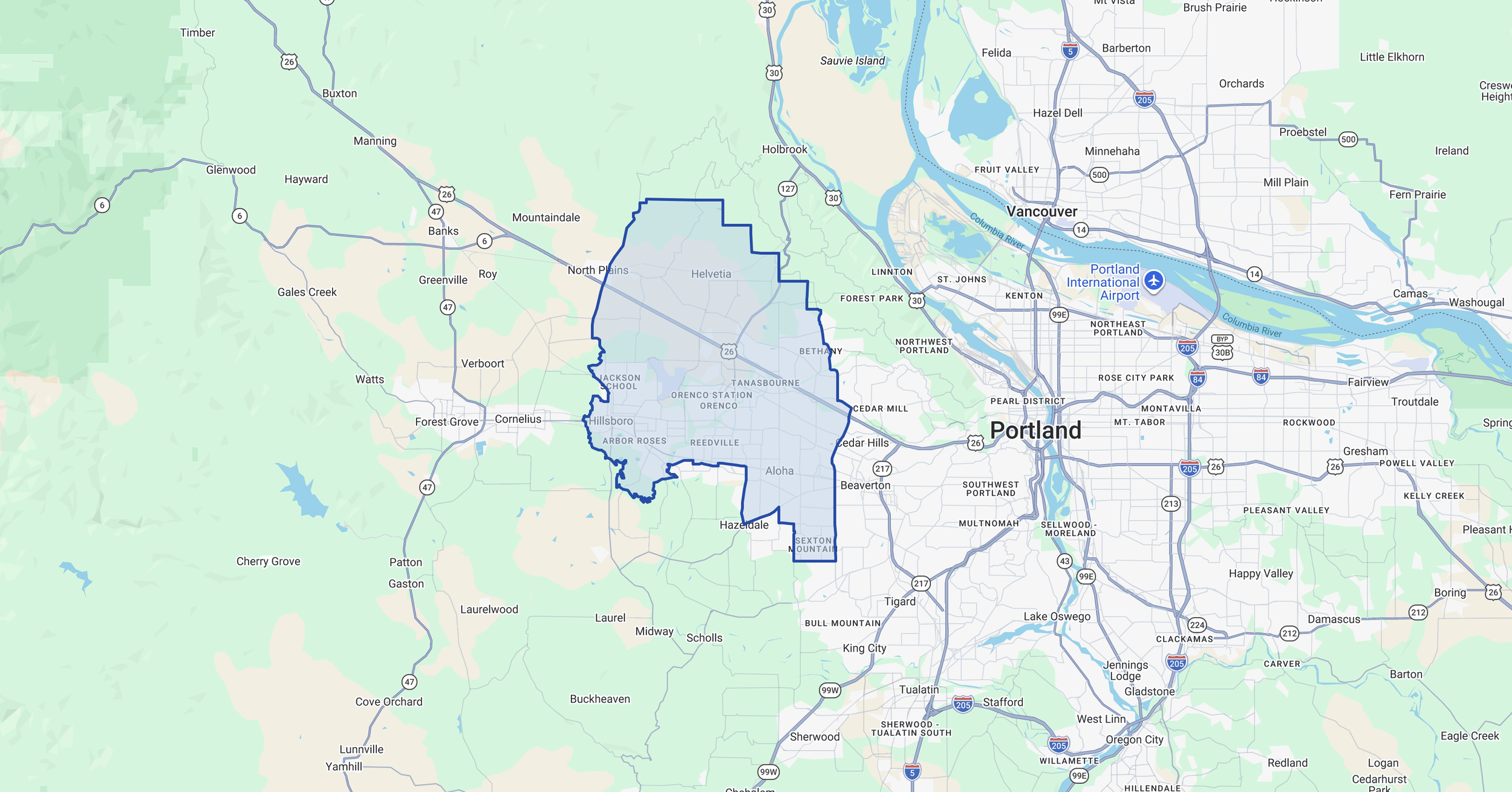

HILLSBORO & SUNSET CORRIDOR

Westside industrial and flex with a mix of business parks and industrial inventory tied to US-26 access and major employment nodes. Demand is often driven by westside customer proximity and labor, with timing and availability playing a big role.

Best for: westside-based operations, flex/industrial users, and companies prioritizing US-26 access.

Explore More →

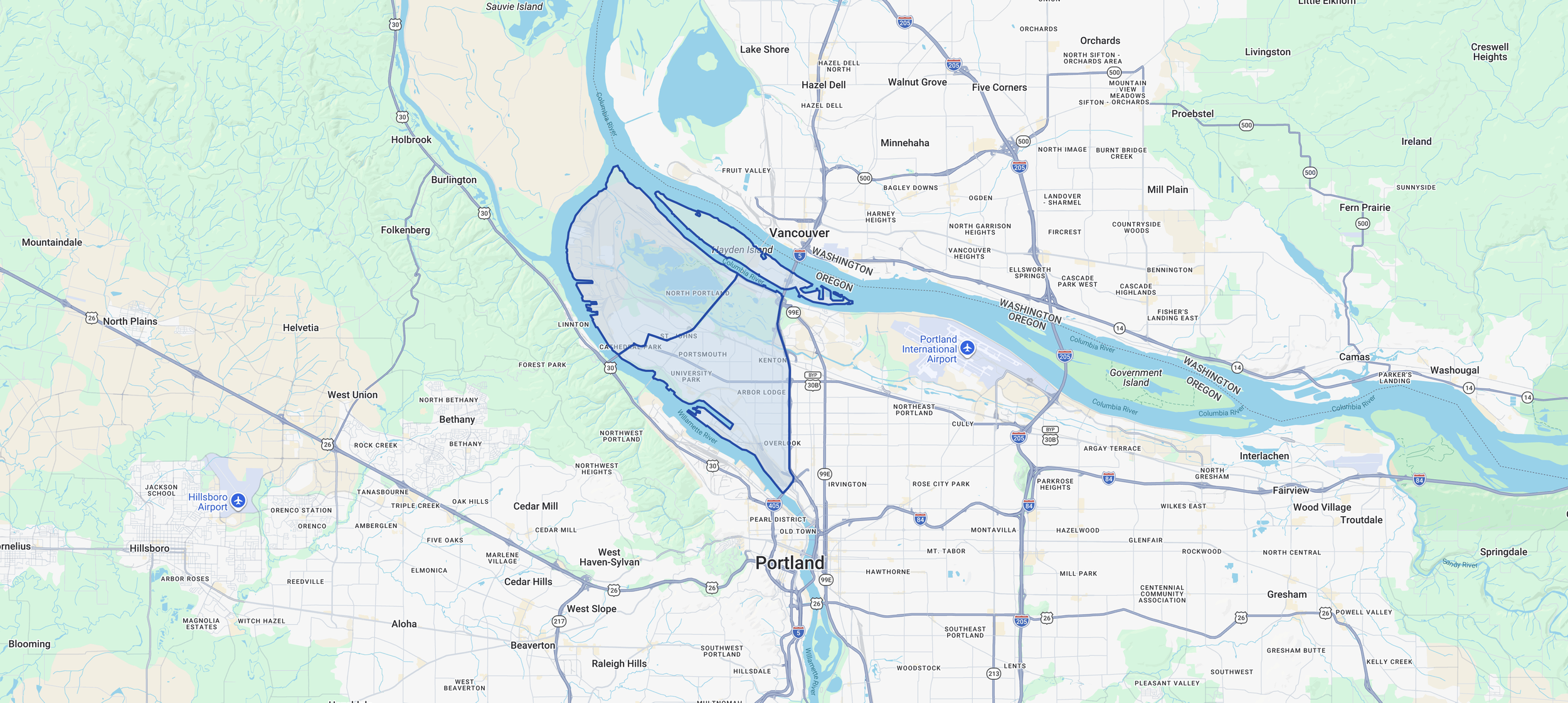

SWAN ISLAND & RIVER GATE

Close-in industrial near the river with a blend of established industrial users and functional building stock. Due diligence on loading, power, and site constraints is especially important given older inventory and tighter sites.

Best for: manufacturing/service users prioritizing proximity to the central city.

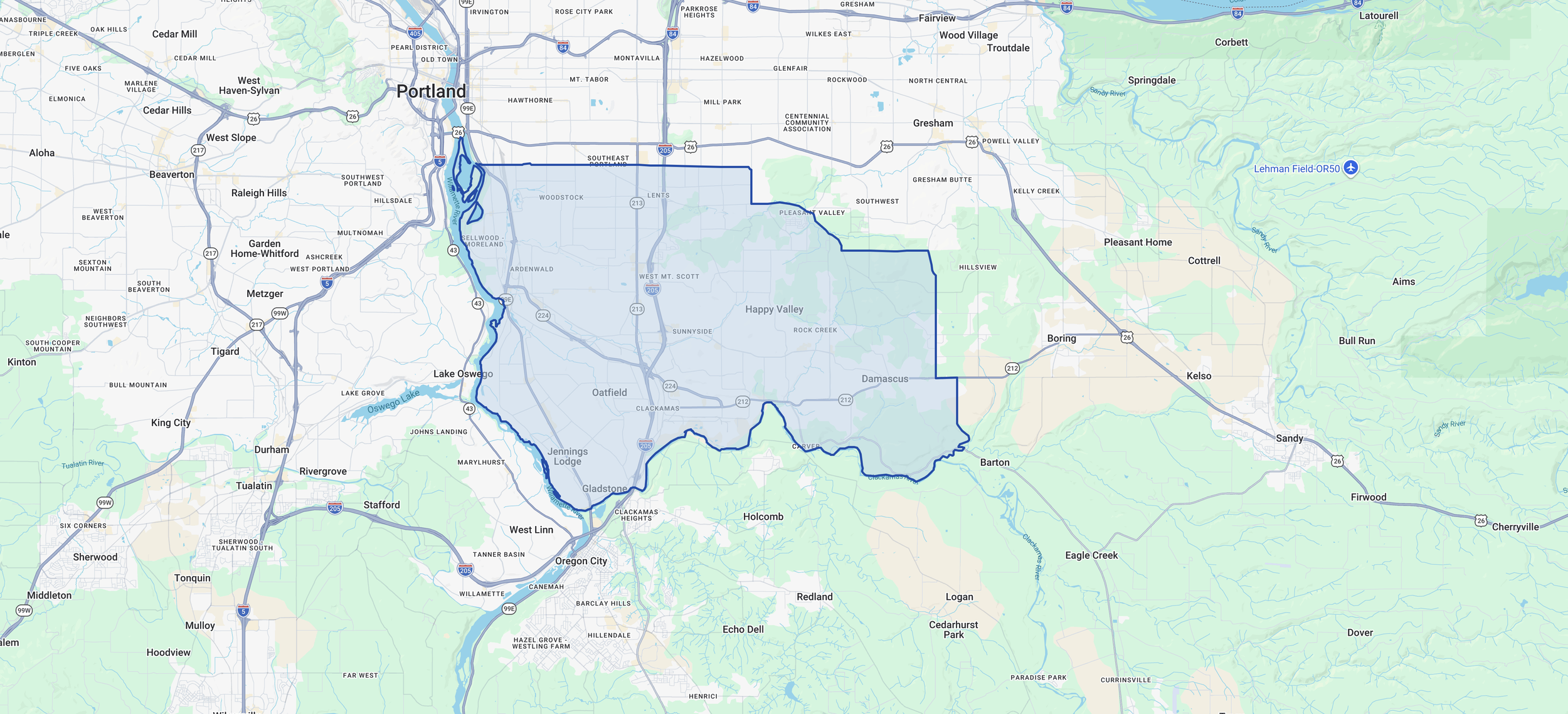

CLACKAMAS & OUTER SE INDUSTRIAL

Large and diverse corridor with strong regional access and a deep base of contractor/service and light industrial users. Often offers practical functionality—parking, loading flexibility, and workable buildouts—with broad pricing across building ages.

Best for: contractor/service, light industrial, and tenants optimizing function and commute patterns.

Explore More →

NW PORTLAND & GUILDS LAKE

Core industrial pocket with strong access to Hwy 30 and quick connectivity to Downtown/North Portland. Product can be supply-constrained and site sizes tighter, so loading configuration and circulation need early verification.

Best for: service and industrial users who value close-in location over newer specs.

Explore More →

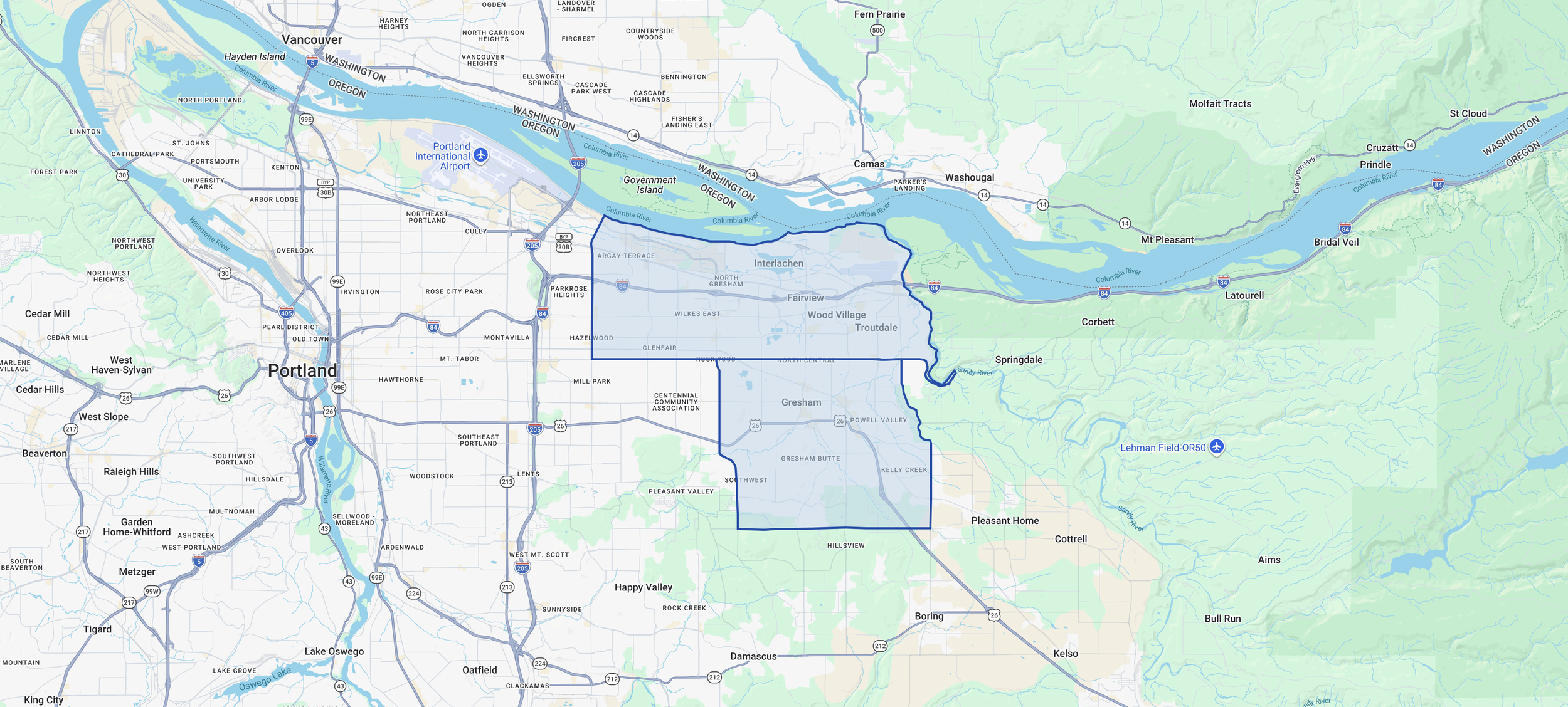

GRESHAM & EAST COLUMBIA CORRIDOR

East metro inventory that often provides more space-for-the-money and larger sites relative to close-in corridors. Last-mile time and labor commute patterns should be weighed against rent/value advantages.

Best for: users needing more square footage, outdoor space potential, or value positioning.

Explore More →

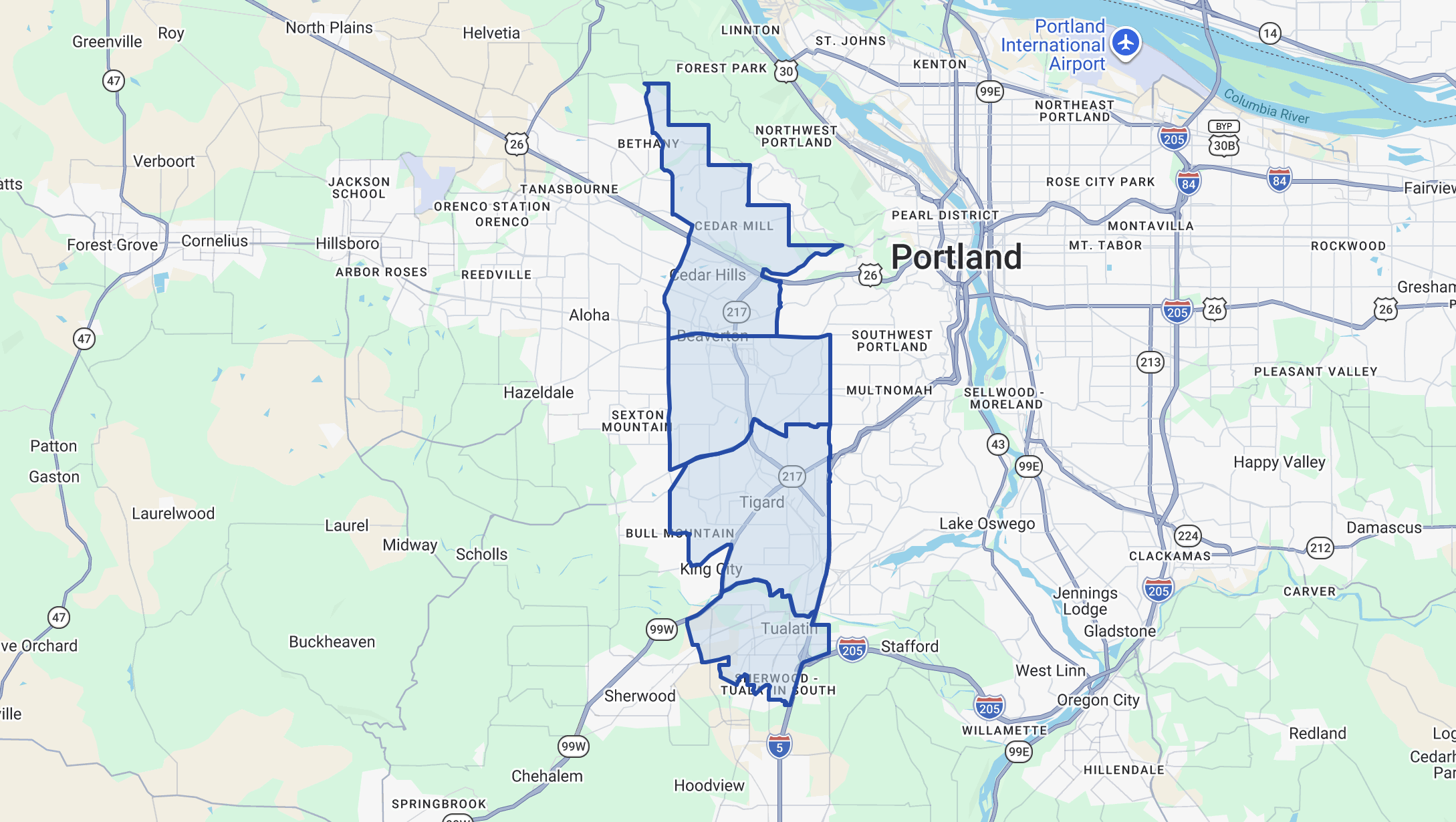

217 CORRIDOR, BEAVERTON, TIGARD, & TUALATIN

Westside corridor shaped by 217/I-5 access and a large base of flex and light industrial options. Options can move quickly, and parking/office ratio plus truck access are common differentiators between buildings.

Best for: contractor/service fleets and flex users serving west metro customers.

Explore More →

NEED A SHORTLIST?

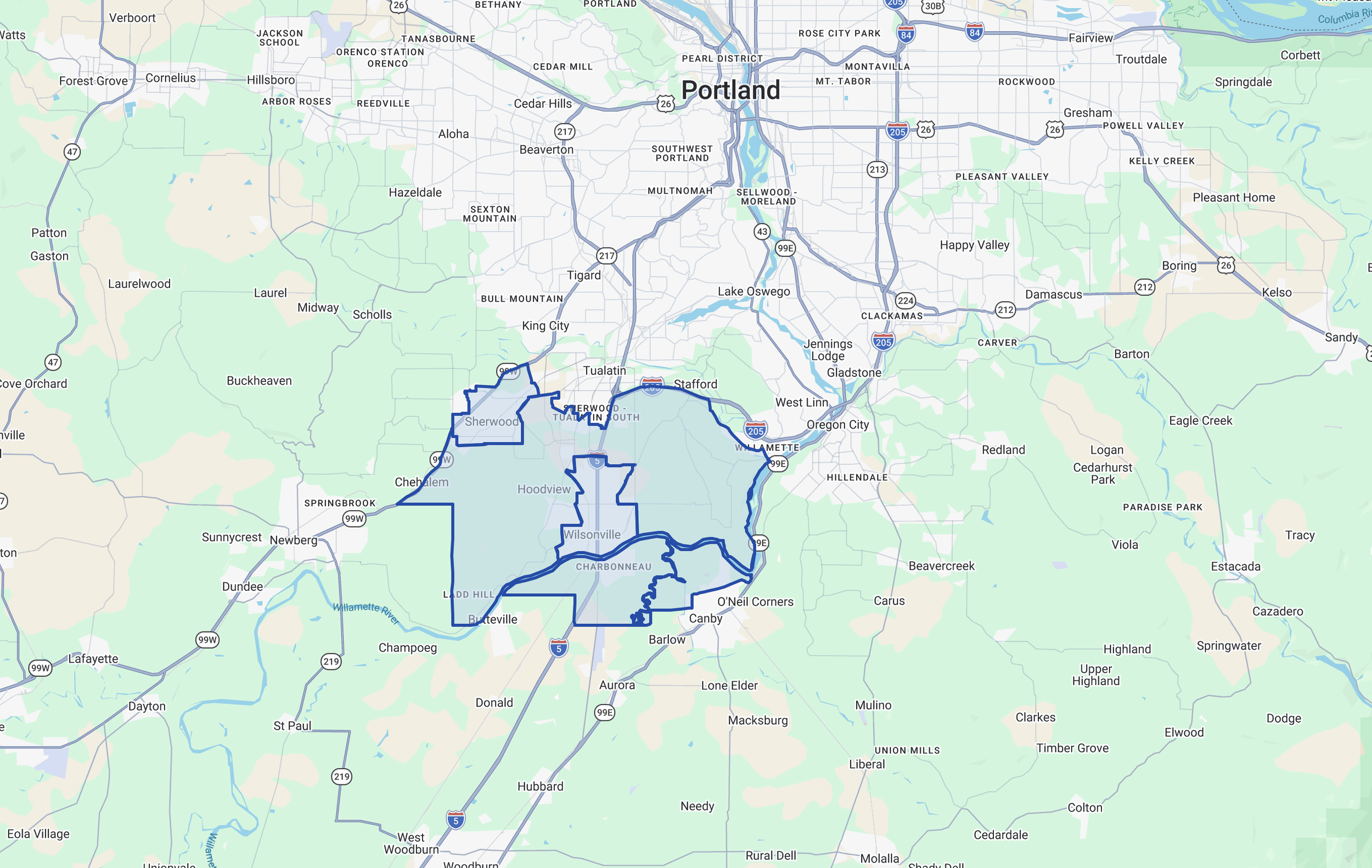

WILSONVILLE & SHERWOOD

Southwest industrial market along I-5 with a mix of newer distribution and business-park industrial, often with stronger site utility than closer-in options. Users commonly weigh access, labor commutes, and site functionality (truck courts, parking, yard).

Best for: regional distribution and industrial users who need I-5 access and functional sites.

Explore More →

Share use, size, timing, and must-haves (loading, yard, power). Receive a realistic availability shortlist and next-step plan aligned to current market conditions.

COMMON QUESTIONS ABOUT PORTLAND INDUSTRIAL SUBMARKETS

-

Most distribution users start with Airport Way / Columbia Corridor (PDX adjacency, I-84/I-205 access, strong warehouse inventory). For I-5 north/south connectivity and SW Washington reach, I-5 North / Marine Drive and Vancouver, WA are also common contenders. The “best” choice usually comes down to customer lanes, labor/commute patterns, trailer parking needs, and the loading configuration you can actually secure.

-

Trailer parking and secured yard tend to be most feasible in larger-site corridors such as Airport Way / Columbia Corridor, Clackamas / SE Industrial, Gresham / East County, and parts of Vancouver, WA. Close-in markets (Central Eastside, Swan Island) generally have tighter sites, more constraints, and fewer true yard options.

-

Dock loading is usually prioritized for high-throughput distribution and typically clusters more in Airport Way / Columbia Corridor and newer logistics-oriented pockets. Grade loading can be perfectly workable for contractors, service, light manufacturing, and mixed-use operations, and opens up more options in Clackamas, Gresham/East County, and parts of the Westside. The bigger driver than “dock vs grade” is often door count, truck court depth, circulation, and parking.

-

Rent differences usually track:

Location/access (freeway adjacency, last-mile time, customer proximity)

Building spec (clear height, loading mix, sprinklers/ESFR, column spacing)

Site utility (yard, trailer parking, truck courts, turning radius)

Age/condition (functional older product vs newer distribution)

Constraint level (zoning/use restrictions, limited supply, close-in infill)

Headline asking rent is only part of the story—NNN/CAM structure and concessions often change effective economics.

-

A good rule: start 12–18 months before expiration for most industrial tenants, earlier if there’s meaningful buildout, specialized power/loading, or multiple decision-makers. If the current building has major functional issues (yard, loading, power, parking) or the landlord’s early proposal is off-market, a parallel relocation search creates leverage and reduces risk. Waiting until the last few months usually leads to worse terms and fewer real options.

-

Compare them on a consistent basis:

What’s included/excluded (management fees, admin, capital items, roof/structure, reserves)

Base-year vs direct NNN and any “gross-up” language

Expense caps (especially on controllables)

Audit rights and timing

Utilities (separately metered vs included)

Two buildings with the same asking rent can have very different total occupancy costs because CAM definitions vary widely.

-

Typically:

Power (available amps/voltage/3-phase, upgrade feasibility and lead times)

Clear height and layout (workflow, equipment footprint, column spacing)

Loading (grade access often matters; dock can still be useful)

Ventilation/HVAC (process needs, comfort, makeup air)

Floor and site (slab condition, parking, outdoor storage, truck access)

Zoning/use compliance (noise, hours, materials, emissions—where applicable)

GET IN TOUCH

Contact Matt Lyman at Norris & Stevens about any Portland commercial real estate need—leasing, renewals, relocations, site selection, lease-up strategy, tenant/landlord representation, acquisitions, dispositions, or a quick market opinion.

Share your property type, size, location/submarket, timing, and what decision you’re trying to make, and Matt will follow up with clear next steps and relevant market context.

Coverage includes industrial, office, retail, and flex across the Portland metro—217 Corridor (Beaverton/Tigard/Tualatin), Central Eastside, Airport Way/Columbia Corridor, Clackamas, and Vancouver, WA.