SWAN ISLAND & RIVERGATE

INDUSTRIAL REAL ESTATE - PORTLAND, OR

Swan Island and Rivergate are core North Portland industrial areas known for close-in access, established industrial tenancy, and a broad mix of functional building stock. The corridor is often evaluated for proximity to the central city and river/port-oriented uses, with building and site constraints that vary widely by property. This page outlines what typically fits here, how to evaluate options, and the deal terms that most affect total occupancy cost.

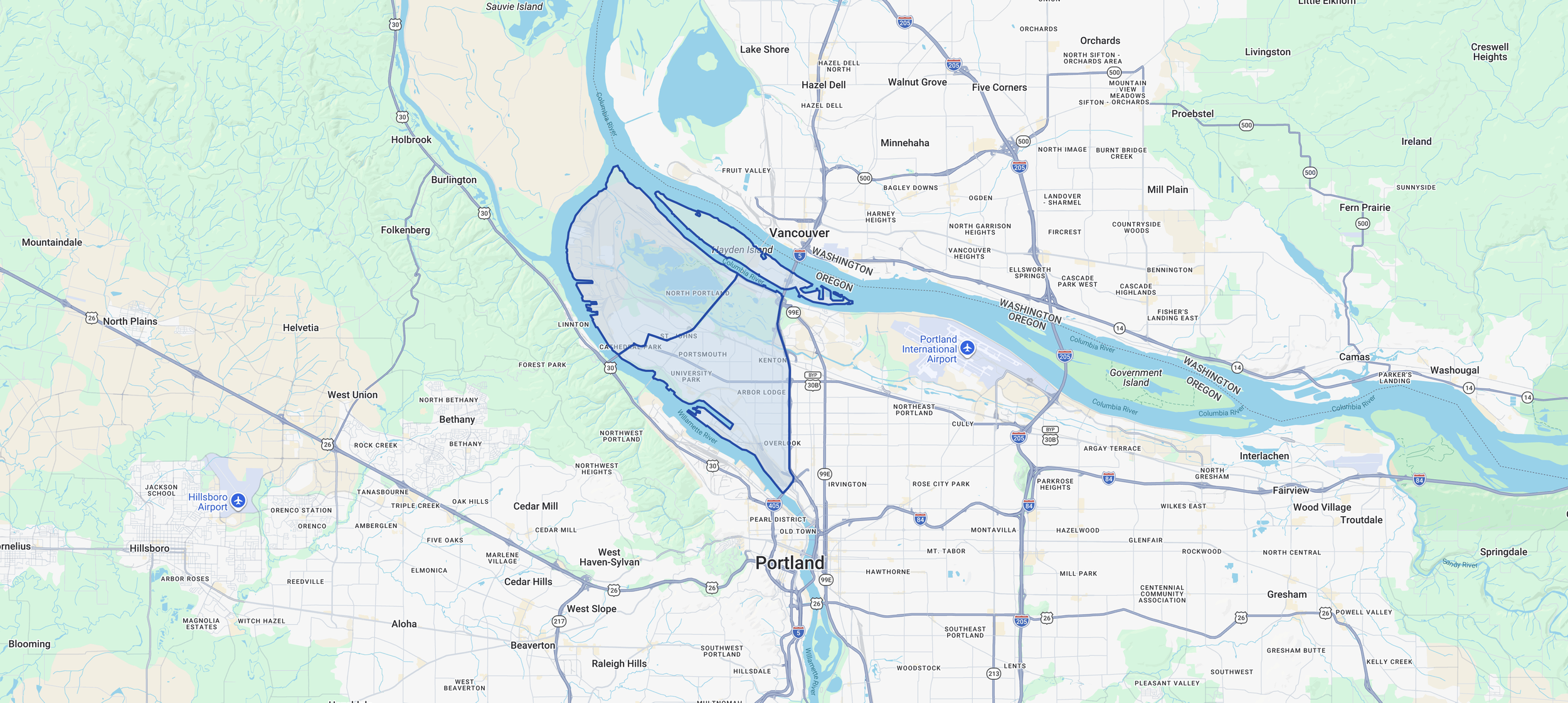

Swan Island sits just northwest of Downtown Portland along the Willamette River, while Rivergate is farther north along the Columbia River near the Portland–St. Johns area. Together, they form a major North Portland industrial cluster with strong connectivity via Hwy 30 and nearby I-5 access. Boundaries can vary by listing, but the practical focus is close-in industrial inventory serving North Portland and regional freight routes.

QUICK SNAPSHOT

Known For

Close-in North Portland location with established industrial tenancy

Mix of warehouse, manufacturing, and service/industrial inventory

River and port-adjacent industrial context

Typical User Profiles

Manufacturing and light industrial operations

Service/contractor and fleet users

Warehouse users prioritizing proximity over newest specs

Best Fits

Users needing North Portland access and close-in response time

Operations that can work within functional building/site constraints

Tenants focused on practicality: layout, loading, power, and maintenance clarity

Common Constraints

Older, functional inventory can require deeper diligence on condition and systems

Site circulation, loading, and parking can be limiting depending on the property

Power, sprinklers, and maintenance responsibility language can be deal-critical

RENT, PRICING, AND DEAL TERMS

Asking rent in Swan Island/Rivergate often reflects a combination of proximity, functionality, building condition, and site utility. Concessions and expense language can materially change effective economics—especially in functional inventory where repair and maintenance responsibility needs to be clear.

Negotiation Levers That Matter

Concessions: free rent, TI/turnkey packages for office or workflow changes

NNN/CAM language: inclusions/exclusions, admin/management fees, capital items

Caps + audit rights: especially for controllable expenses

Maintenance responsibilities: clearly define roof/structure/HVAC/parking lot scope

Options: renewal, expansion, termination rights when justified by operational risk

How Proposals Should Compare

Compare total occupancy cost using effective economics: base rent + operating expenses + concessions amortized over the term + tenant costs (improvements, moving, downtime). In functional inventory, maintenance scope and CAM definitions can change the “real” deal more than the headline rate.

SUBMARKET FAQ

-

Manufacturing, service/contractor, and warehouse users prioritizing North Portland proximity—especially when the building layout and site constraints match the operation.

-

Inventory often skews functional, but there is variation. Condition, systems, and site utility should be verified early.

-

Loading/circulation, power, sprinklers, roof/structure condition, and how maintenance responsibilities are assigned in the lease.

-

Confirm what’s included/excluded, base-year vs NNN structure, management/admin fees, capital treatment, caps on controllables, and audit rights.

-

Often 12–18 months before expiration, earlier for specialized operations or when improvements are likely.

-

Unverified power/sprinkler needs, unclear maintenance responsibilities, CAM language surprises, or site constraints discovered after the LOI.

RELATED

GET IN TOUCH

Contact Matt Lyman at Norris & Stevens about any Portland commercial real estate need—leasing, renewals, relocations, site selection, lease-up strategy, tenant/landlord representation, acquisitions, dispositions, or a quick market opinion.

Share your property type, size, location/submarket, timing, and what decision you’re trying to make, and Matt will follow up with clear next steps and relevant market context.

Coverage includes industrial, office, retail, and flex across the Portland metro—217 Corridor (Beaverton/Tigard/Tualatin), Central Eastside, Airport Way/Columbia Corridor, Clackamas, and Vancouver, WA.