Central East Side & Inner SE

Central Eastside industrial guidance for close-in flex users needing central access, workable parking, and delivery practicality.

ABOUT CENTRAL EAST SIDE & INNER SOUTH EAST

Central Eastside and Inner Southeast are close-in Portland industrial areas where central access and mixed-use flexibility often matter as much as pure warehouse specs. Inventory typically includes flex/industrial, creative-style spaces, functional older industrial, and smaller footprints where parking, zoning fit, and layout can be the deciding factors. This page covers what usually works here, how to evaluate options quickly, and which deal terms most affect total occupancy cost.

WHAT’S DIFFERENT ABOUT THIS SUBMARKET

Central Eastside and Inner Southeast are Portland’s most close-in, mixed-use industrial pockets, where access to the core and flexible layouts often matter more than pure warehouse specs. Inventory skews toward flex/creative-industrial, showroom, and functional smaller footprints, with constraints that don’t show up in headline listings—especially parking, delivery access in tight streets, and use compatibility with nearby neighbors. The fastest way to narrow options is to confirm parking and delivery practicality first, then evaluate layout/office ratio and any restrictions tied to hours, noise, or outdoor activity.

LOCATION INFORMATION

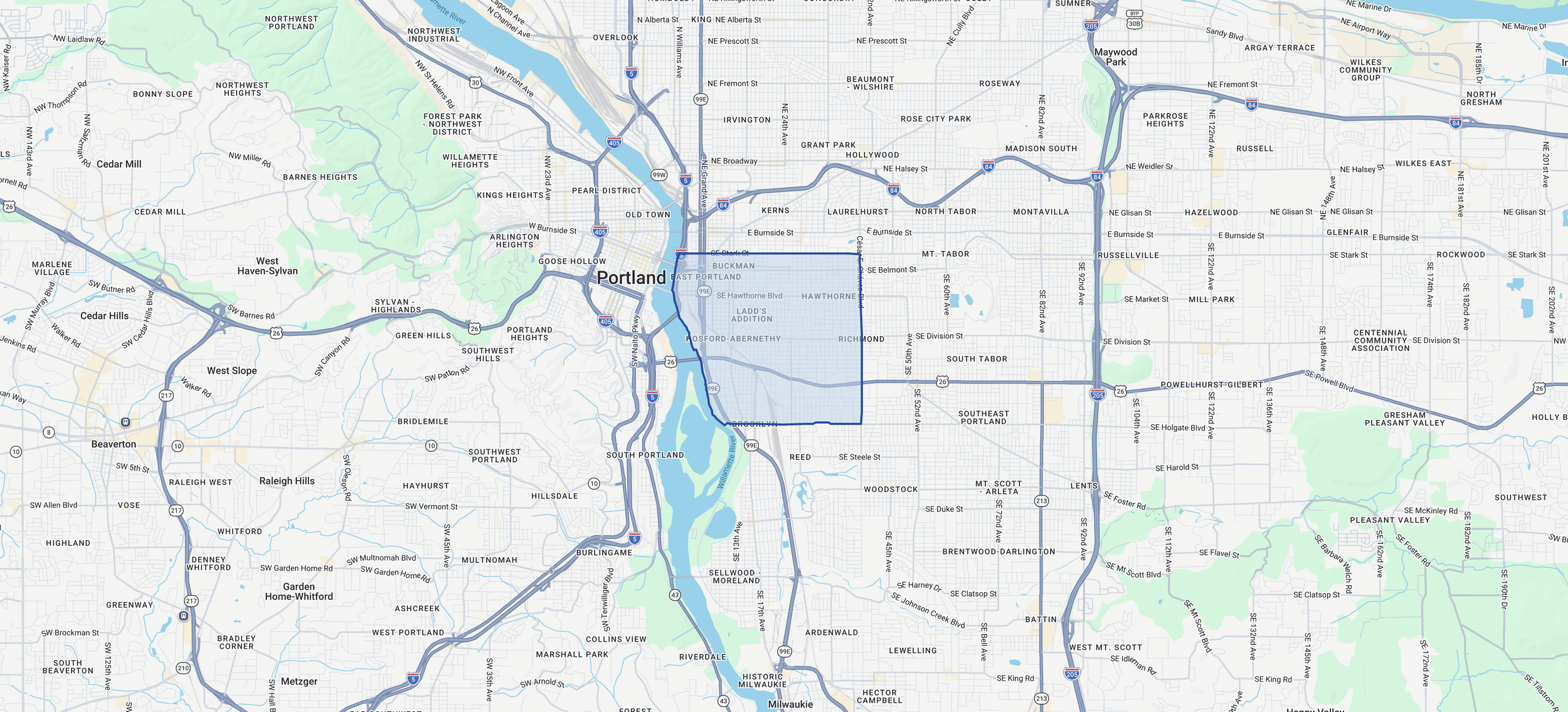

Central Eastside generally refers to the close-in eastside district just across the river from Downtown Portland, extending through inner Southeast industrial pockets. The area is anchored by quick access to central Portland and primary east-west routes, with many properties clustered around close-in corridors and mixed-use industrial streets. Boundaries vary by listing; the practical focus is close-in flex and industrial space with strong central access.

QUICK SNAPSHOT

Known For

Close-in location with strong central access and visibility

Flex/industrial and creative-style inventory mixed with functional older industrial

Smaller sites and tighter parking/yard constraints than outer submarkets

Typical User Profiles

Creative and showroom/flex users

Light production, assembly, and maker space users

Service businesses prioritizing central response times and proximity to clients

Best Fits

Users who need central access and can operate with limited yard/trailer needs

Tenants valuing a flexible layout (warehouse + office/showroom)

Companies that benefit from visibility and proximity to the core

Common Constraints

Parking can be a limiting factor depending on use and hours

Yard and trailer parking are uncommon; site constraints vary widely

Zoning/use restrictions and neighbor impacts can be more relevant close-in

Older buildings may require closer diligence on condition and systems

RENT, PRICING, AND DEAL TERMS

Negotiation Levers

Concessions: free rent, TI/turnkey packages, phased buildout

NNN/CAM language: inclusions/exclusions, admin/management fees, capital items

Maintenance responsibilities: clarify HVAC, roof/structure, plumbing, and common areas

Options: renewal, expansion, early termination where justified

Use/alterations language: signage, operating hours, improvements, and approvals

Mini Case Example

A close-in flex user needed central access but couldn’t compromise on parking and delivery flow. Properties were screened first by parking + delivery practicality, then by layout. The negotiated lease clarified HVAC/roof responsibility and avoided hidden maintenance exposure.

Typical Deal Terms

Central Eastside deals often revolve around parking, delivery practicality, and use compatibility in close-in mixed areas. TI is commonly allocated toward layout efficiency (office/warehouse balance), basic upgrades, and code-driven items. Because older buildings are common, clarity on HVAC/roof responsibilities and after-hours operating expectations is critical.

Deal Killers

Parking doesn’t support staffing or customers (and there’s no workaround).

Delivery access is tight in practice (street geometry, staging, or timing restrictions).

“Cool factor” hides functional issues (layout, power, HVAC, loading).

Comparing Proposals

Compare options using effective economics—not just headline rent. Start with base rent and add operating expenses (NNN/CAM), then factor in concessions like free rent and TI by spreading them over the lease term. For Central Eastside/Inner Southeast, include the costs that often drive the real outcome: parking solutions, delivery constraints (staging, access, timing), any required upgrades (HVAC, electrical, sprinklers), and who is responsible for major repairs. The best deal is the option with the lowest total occupancy cost and the fewest operational surprises—not the lowest quoted rate.

SUBMARKET FAQ

-

Creative/showroom, light production, service users, and tenants who benefit from central access and flexible layouts.

-

Yes—parking can be a primary limiter. Confirm counts, restrictions, and peak-hour needs early.

-

Focus on practical delivery access, turning, and door placement—not just whether a listing says “loading.”

-

Confirm what’s included/excluded, management/admin fees, capital treatment, caps on controllables, and audit rights.

-

Often 12–18 months before expiration; earlier if the space is specialized or downtime-sensitive.

-

Use restrictions, parking constraints, unclear maintenance scope, or buildout costs discovered after LOI.

RELATED

GET IN TOUCH

Contact Matt Lyman at Norris & Stevens about any Portland commercial real estate need—leasing, renewals, relocations, site selection, lease-up strategy, tenant/landlord representation, acquisitions, dispositions, or a quick market opinion.

Share your property type, size, location/submarket, timing, and what decision you’re trying to make, and Matt will follow up with clear next steps and relevant market context.

Coverage includes industrial, office, retail, and flex across the Portland metro—217 Corridor (Beaverton/Tigard/Tualatin), Central Eastside, Airport Way/Columbia Corridor, Clackamas, and Vancouver, WA.