Clackamas & Outer SE Industrial

Clackamas/Outer SE industrial guidance for contractor and service users needing practical access, parking utility, and functional warehouse layouts.

ABOUT CLACKAMAS & OUTER SE INDUSTRIAL

Clackamas and Outer Southeast Portland form one of the metro’s most active industrial corridors for contractor/service users, functional warehouse space, and light industrial operations. The area is often chosen for practical site utility—parking, grade loading, and workable layouts—plus strong access to the south and east metro. This page outlines what typically fits here, how to evaluate options quickly, and the deal terms that most affect total occupancy cost.

WHAT’S DIFFERENT ABOUT THIS SUBMARKET

Clackamas and Outer SE skew more function-first than most Portland industrial areas. The corridor is a common fit for contractor/service fleets, suppliers, and light industrial users that need real parking, grade loading, and workable circulation—not just a nice façade. Inventory ranges widely in age and condition, so outcomes are often driven by site utility (yard/staging/parking), power and sprinkler adequacy, and maintenance scope more than headline rent. The fastest way to narrow options is to confirm parking/fleet needs, yard permissions, and loading setup first, then diligence systems and expense language to avoid late surprises.

LOCATION INFORMATION

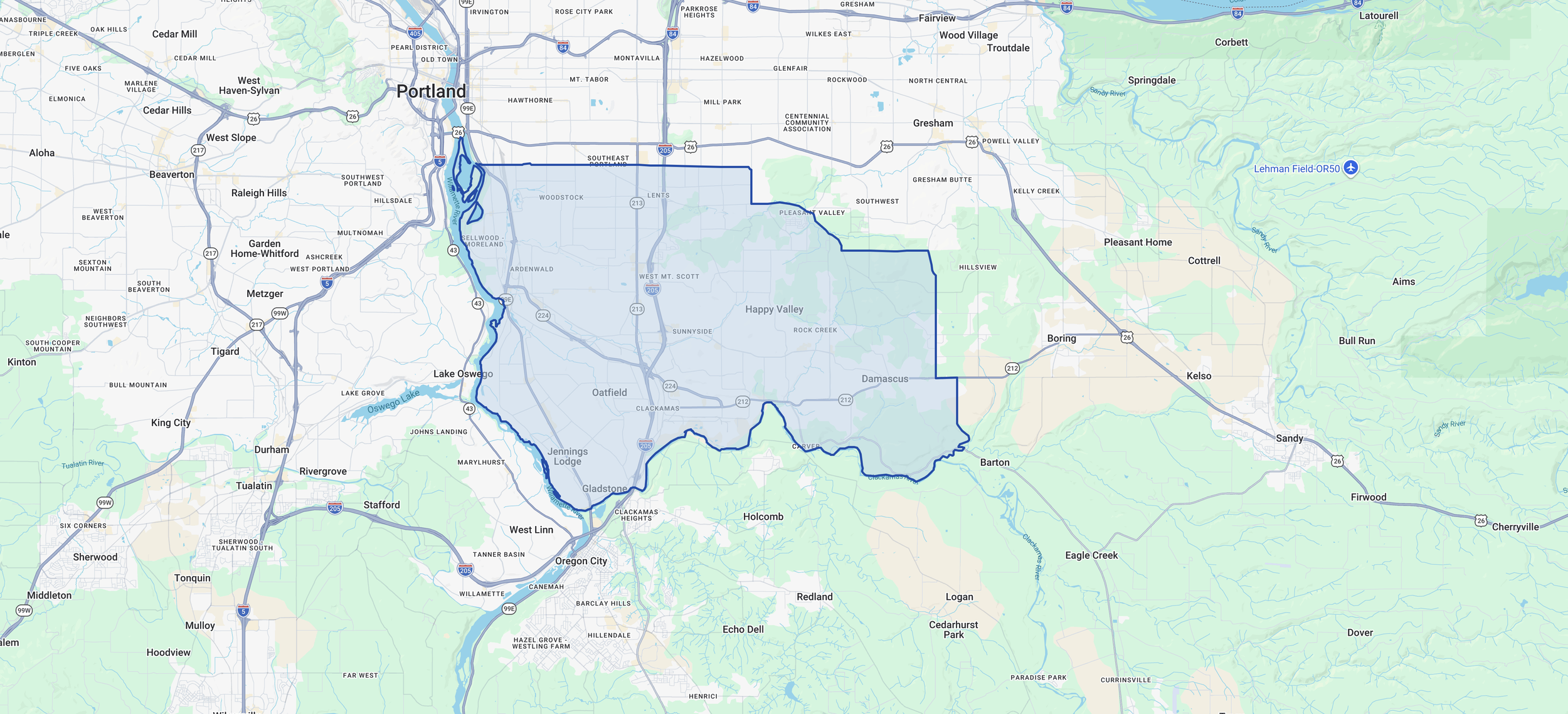

Clackamas/Outer SE generally refers to industrial areas east and southeast of Portland’s core, including Clackamas and nearby outer-SE corridors with strong regional connectivity to I-205 and key arterials serving the south and east metro. Boundaries vary by listing, but the practical focus is functional industrial inventory with good access, parking, and serviceable layouts.

QUICK SNAPSHOT

Known For

Large base of contractor/service and light industrial users

Functional warehouse and flex inventory with varied building ages

Practical site utility: parking, grade access, and workable circulation

Typical User Profiles

Contractors, service fleets, and suppliers

Light manufacturing, assembly, and distribution

Businesses needing warehouse + office/flex functionality

Best Fits

Users prioritizing function, access, and parking over close-in location

Operations needing grade loading and straightforward logistics

Tenants looking for a broad mix of sizes and building types

Common Constraints

Condition and systems vary widely—diligence on roof/HVAC/power matters

Yard/trailer/parking availability differs by property—verify early

Expense and maintenance responsibility language can materially change the deal

RENT, PRICING, AND DEAL TERMS

Negotiation Levers

Concessions: free rent, TI/turnkey packages for office/workflow changes

NNN/CAM language: inclusions/exclusions, admin/management fees, capital items

Caps + audit rights: especially on controllable expenses

Maintenance responsibilities: roof/structure/HVAC/parking lot scope and standards

Options: renewal/expansion/termination rights where operational continuity matters

Comparing Proposals

Compare total occupancy cost using effective economics: base rent + operating expenses + concessions amortized over term + tenant costs (improvements, moving, downtime). In practical industrial product, maintenance scope, expense definitions, and site utility often drive the real outcome.

Deal Killers

Fleet parking or yard use assumed—but prohibited or not exclusive.

Condition issues (roof, paving, drainage) surface late and aren’t addressed in the lease.

Operating expense language shifts major lot/repair costs onto the tenant.

Typical Deal Terms

Clackamas/Outer SE is function-first: concessions commonly target practical improvements (lighting, basic buildout, door/yard condition) and clear maintenance responsibilities. Because users often have fleets, leases frequently need precision around parking allocations, yard permissions, and pavement/lot repair language.

Mini Case Example

Compare total occupancy cost using effective economics: base rent + operating expenses + concessions amortized over term + tenant costs (improvements, moving, downtime). In practical industrial product, maintenance scope, expense definitions, and site utility often drive the real outcome.

SUBMARKET FAQ

-

Contractor/service, light industrial, and warehouse users prioritizing practical access, parking, and functional layouts.

-

The area supports a wide mix of manufacturers, logistics providers, and industrial services. Notable examples in the broader Clackamas County industrial base include PCC Structurals, Warn Industries, Pacific Seafood, US Reddaway, Emmert International, and Oregon Iron Works.

-

It’s more feasible than close-in submarkets, but it varies widely—confirm permitted use, exclusivity, and lease language early.

-

Loading/circulation, parking, power, sprinkler adequacy, and maintenance responsibilities for roof/HVAC/lot.

-

Confirm what’s included/excluded, management/admin fees, capital treatment, caps on controllables, and audit rights.

-

Often 12–18 months before expiration; earlier if the space is specialized or downtime-sensitive.

-

Use restrictions, parking constraints, unclear maintenance scope, or buildout costs discovered after LOI.

RELATED

GET IN TOUCH

Contact Matt Lyman at Norris & Stevens about any Portland commercial real estate need—leasing, renewals, relocations, site selection, lease-up strategy, tenant/landlord representation, acquisitions, dispositions, or a quick market opinion.

Share your property type, size, location/submarket, timing, and what decision you’re trying to make, and Matt will follow up with clear next steps and relevant market context.

Coverage includes industrial, office, retail, and flex across the Portland metro—217 Corridor (Beaverton/Tigard/Tualatin), Central Eastside, Airport Way/Columbia Corridor, Clackamas, and Vancouver, WA.