Gresham & East Columbia Corridor

East metro industrial guidance for warehouse and service users who need I-84 access, practical parking, and functional logistics.

ABOUT GRESHAM & EAST COLUMBIA CORRIDOR

Gresham and the East Columbia Corridor are often evaluated as the east metro alternative to close-in Portland—especially for users who need functional warehouse space, workable circulation, and value relative to the core. Inventory ranges from contractor/service and light industrial product to distribution-oriented facilities tied to I-84 access. This page covers what typically fits here, how to screen options quickly, and the deal terms that most affect total occupancy cost.

WHAT’S DIFFERENT ABOUT THIS SUBMARKET

This corridor is driven by function and access more than presentation. Decisions tend to hinge on grade vs dock loading, truck circulation, and parking/fleet utility, plus whether a site can handle real delivery patterns without friction. Inventory varies widely in condition and infrastructure, so outcomes are often determined by power, sprinkler adequacy, and maintenance scope rather than headline rent. The fastest way to narrow options is to confirm loading/circulation and parking first, then diligence systems and expense language.

LOCATION INFORMATION

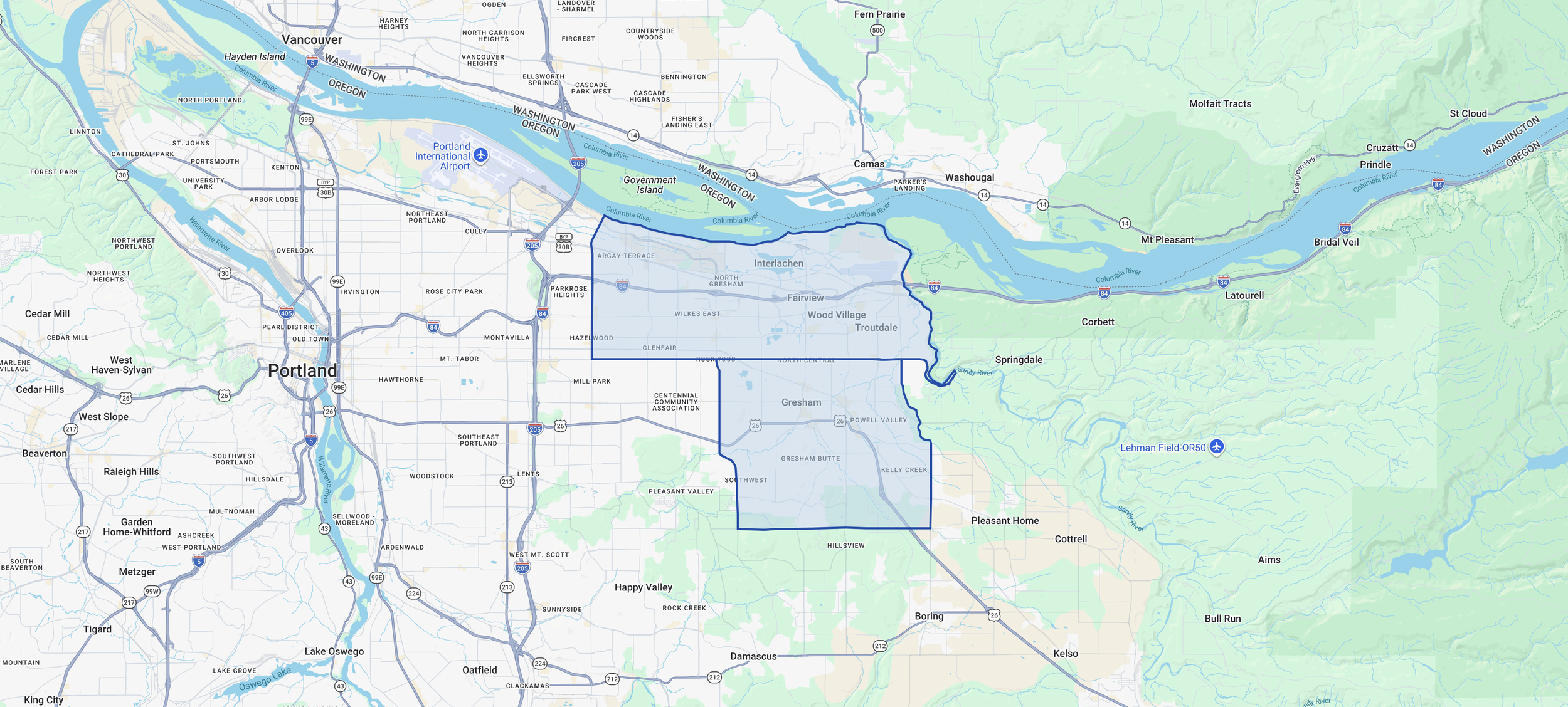

Gresham and the East Columbia Corridor generally refer to the east metro industrial pockets around Gresham and nearby nodes along the I-84 route through East Multnomah County. Boundaries vary by listing; the practical focus is eastside industrial inventory with strong regional connectivity and a broad mix of building sizes and site layouts that serve distribution and service operations.

QUICK SNAPSHOT

Known For

East-metro value and functional industrial inventory

Practical logistics tied to I-84 access

Mix of warehouse, contractor/service, and light industrial users

Typical User Profiles

Regional service and contractor fleets

Distribution and last-mile operations serving the east metro

Light manufacturing and assembly users

Best Fits

Users prioritizing functional layouts and parking utility

Operations that need predictable delivery access and circulation

Tenants seeking flexible size options and lower effective costs vs close-in

Common Constraints

Condition and systems vary—diligence on roof/HVAC/power matters

Circulation can be site-specific—verify turning and staging early

Yard/outdoor use assumptions can be wrong—confirm permitted use in writing

Expense and maintenance language can materially change effective economics

RENT, PRICING, AND DEAL TERMS

Negotiation Levers

Concessions: free rent, TI, phased improvements, delivery condition clarity

NNN/CAM language: inclusions/exclusions, admin fees, capital items, management fees

Expense controls: caps on controllables, audit rights, reconciliation clarity

Maintenance scope: roof/structure/HVAC/lot standards and responsibility

Options: renewal and expansion rights for growth planning

Comparing Proposals

Compare total occupancy cost using effective economics: base rent + operating expenses + concessions amortized over term + tenant costs (improvements, moving, downtime). In functional industrial product, maintenance scope, expense definitions, and infrastructure often drive the real outcome.

Typical Deal Terms

Gresham/East Columbia deals often require diligence on infrastructure (power, sprinklers, condition) and on site utility(parking, circulation). Concessions frequently show up as free rent for move timing, TI for functional upgrades, and clear maintenance scope for older assets.

Deal Killers

A light industrial user needed practical loading, parking, and reliable systems. The shortlist was screened for infrastructure first (power/sprinklers), then by circulation. Negotiations tightened maintenance scope and operating expense definitions to stabilize effective cost.

Mini Case Example

Power/sprinklers inadequate for the intended use.

Yard/staging expectations aren’t permitted or aren’t documented.

Circulation limitations create delivery friction that’s discovered too late.

SUBMARKET FAQ

-

Often, yes—especially on a cost-per-square-foot basis. The right comparison is total occupancy cost plus logistics and staffing realities.

-

Functional warehouse and contractor/service space is common, with distribution-oriented product in certain nodes depending on site layout and access.

-

Very. Site access and staging can vary dramatically. Confirm turning, delivery paths, and any constraints early.

-

Sometimes, but it must be verified. Confirm permitted use, exclusivity, screening, and lease language before relying on it operationally.

-

Power availability, sprinkler adequacy, roof condition, and CAM/maintenance scope—especially on older or functional buildings.

-

Typically 12–18 months out; earlier if the operation needs yard, heavy power, special loading, or significant improvements.

RELATED

GET IN TOUCH

Contact Matt Lyman at Norris & Stevens about any Portland commercial real estate need—leasing, renewals, relocations, site selection, lease-up strategy, tenant/landlord representation, acquisitions, dispositions, or a quick market opinion.

Share your property type, size, location/submarket, timing, and what decision you’re trying to make, and Matt will follow up with clear next steps and relevant market context.

Coverage includes industrial, office, retail, and flex across the Portland metro—217 Corridor (Beaverton/Tigard/Tualatin), Central Eastside, Airport Way/Columbia Corridor, Clackamas, and Vancouver, WA.