Hillsboro & Sunset Corridor

Hillsboro/Sunset Corridor industrial guidance for westside business-park flex users needing US-26 access, parking utility, and office ratio.

ABOUT HILLSBORO & SUNSET CORRIDOR

Hillsboro and the Sunset Corridor are core Westside industrial areas shaped by US-26 access, major employment nodes, and a mix of business parks, flex/industrial, and functional warehouse inventory. Users often prioritize workforce proximity, Westside customer access, and commute patterns as much as pure building specs. This page outlines what typically fits here, how to evaluate options quickly, and the deal terms that most affect total occupancy cost.

HILLSBORO & SUNSET CORRIDOR

Hillsboro and the Sunset Corridor are the Westside’s primary business-park flex/industrial corridor, anchored by US-26 (Sunset Highway) and major employment nodes. Inventory here often emphasizes flex functionality and office ratio as much as warehouse utility, so the real differentiators are parking supply, allowed uses/park rules, and practical loading/circulation (not just “it has a grade door”). The fastest way to narrow options is to confirm office percentage, parking, and any restrictions first, then evaluate loading, power, and expense language.

LOCATION INFORMATION

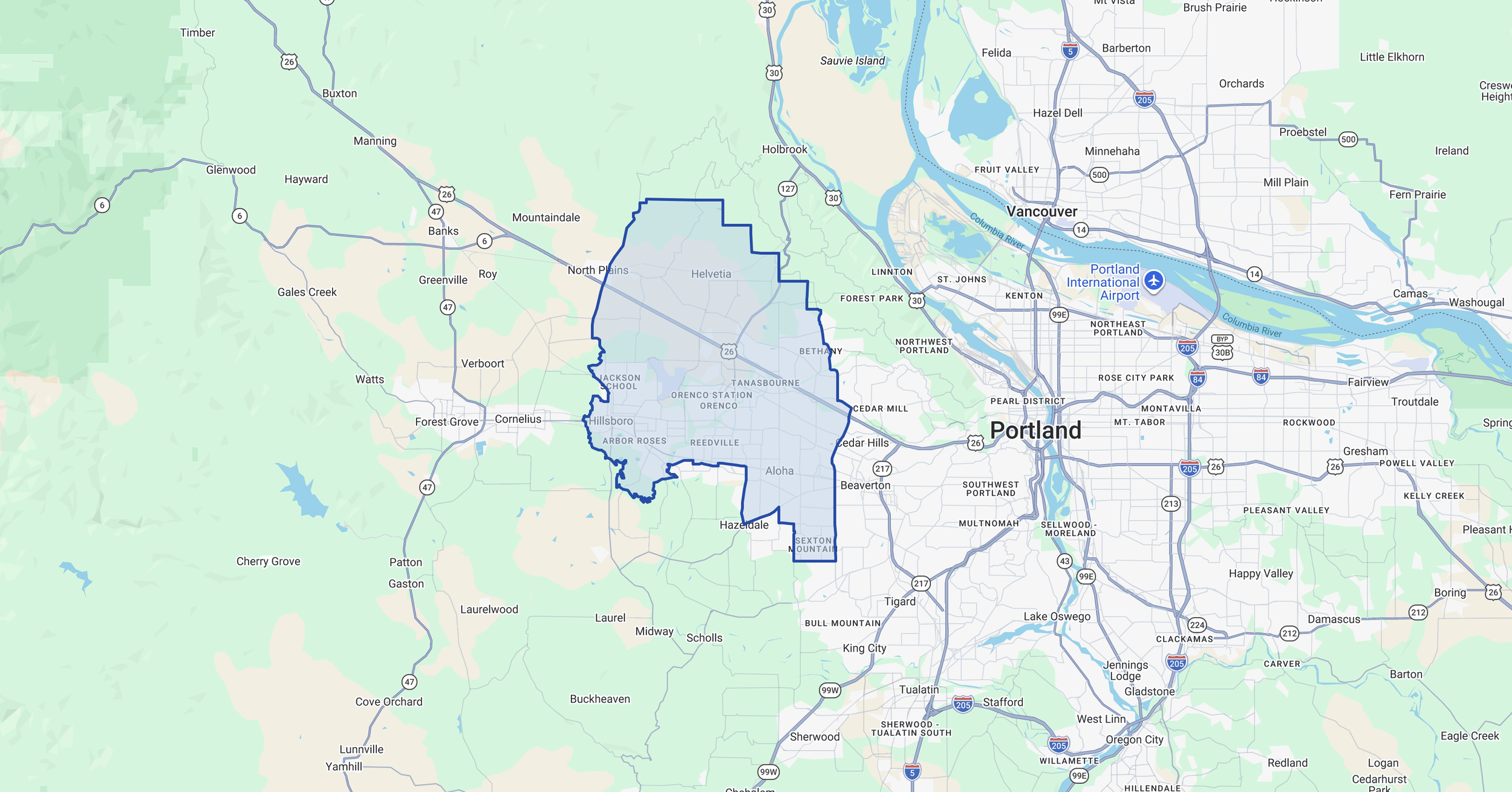

Hillsboro and the Sunset Corridor generally refer to Westside industrial and flex pockets along US-26 (Sunset Highway) from the Sunset area through Beaverton and into Hillsboro, including business park clusters near the major US-26 interchanges. Boundaries vary by listing, but the practical focus is Westside inventory with quick US-26 connectivity, access to major employment nodes, and strong proximity to West metro customers and labor.

QUICK SNAPSHOT

Known For

Westside access anchored by US-26 connectivity

Strong mix of flex/industrial and business park inventory, plus functional warehouse options

Demand driven by proximity to Hillsboro/Beaverton employment and West metro customers

Typical User Profiles

Light manufacturing, assembly, and tech-adjacent users

Contractors and service businesses serving the Westside

Flex users needing office/showroom + warehouse functionality

Best Fits

Users prioritizing Westside labor and customer proximity

Operations that benefit from flex layouts and business park functionality

Tenants who want strong access without being in close-in Portland corridors

Common Constraints

Availability can tighten quickly; timing and shortlist discipline matter

Parking and office ratios can be limiting depending on staffing

Truck access and circulation vary widely across “flex” inventory—verify early

RENT, PRICING, AND DEAL TERMS

Negotiation Levers

Concessions: free rent, TI/turnkey packages, phased buildouts

NNN/CAM language: inclusions/exclusions, admin/management fees, capital items

Expense controls: caps on controllables, audit rights, base-year mechanics

Maintenance responsibilities: HVAC and common area allocations in multi-tenant projects

Options: renewal/expansion rights where operational continuity matters

Comparing Proposals

Compare total occupancy cost using effective economics: base rent + operating expenses + concessions amortized over term + tenant costs (improvements, moving, downtime). In flex-heavy Westside inventory, office ratio, parking utility, and expense definitions often drive the “real” deal.

Deal Killers

Parking ratio fails once staffing growth is modeled.

Park rules prohibit fleet/trailer parking or outdoor storage needed for operations.

Space is “flex” on paper but loading/door placement doesn’t work.

Typical Deal Terms

Hillsboro/Sunset Corridor behaves like a business-park flex market. Negotiations often center on office ratio, parking utility, and park rules (signage, fleet vehicles, outdoor storage). TI frequently goes to office reconfiguration and showroom upgrades rather than warehouse improvements. Concessions should reflect office-heavy buildout costs.

Mini Case Example

A service operator required office-forward flex with parking capacity and limited restrictions. Options were screened by office %, parking, and rules before touring. The final deal structured TI for office rework and negotiated clearer allowances for vehicles and signage.

SUBMARKET FAQ

-

Flex/industrial users, light manufacturing/assembly, and Westside service businesses prioritizing labor and customer proximity.

-

Often yes. There is warehouse inventory, but many options are flex/business park product—verify loading and circulation early.

-

Parking, office/warehouse ratio, allowed uses, loading access, and operating expense/CAM definitions.

-

Confirm what’s included/excluded, management/admin fees, capital treatment, caps on controllables, and audit rights.

-

Often 12–18 months before expiration; earlier if the space is specialized or downtime-sensitive.

-

Use restrictions, parking constraints, unclear maintenance scope, or buildout costs discovered after LOI.

RELATED

GET IN TOUCH

Contact Matt Lyman at Norris & Stevens about any Portland commercial real estate need—leasing, renewals, relocations, site selection, lease-up strategy, tenant/landlord representation, acquisitions, dispositions, or a quick market opinion.

Share your property type, size, location/submarket, timing, and what decision you’re trying to make, and Matt will follow up with clear next steps and relevant market context.

Coverage includes industrial, office, retail, and flex across the Portland metro—217 Corridor (Beaverton/Tigard/Tualatin), Central Eastside, Airport Way/Columbia Corridor, Clackamas, and Vancouver, WA.