Wilsonville & Sherwood

South-metro industrial guidance for modern flex and warehouse users who need I-5 access, truck circulation, and room to grow.

ABOUT WILSONVILLE & SHERWOOD

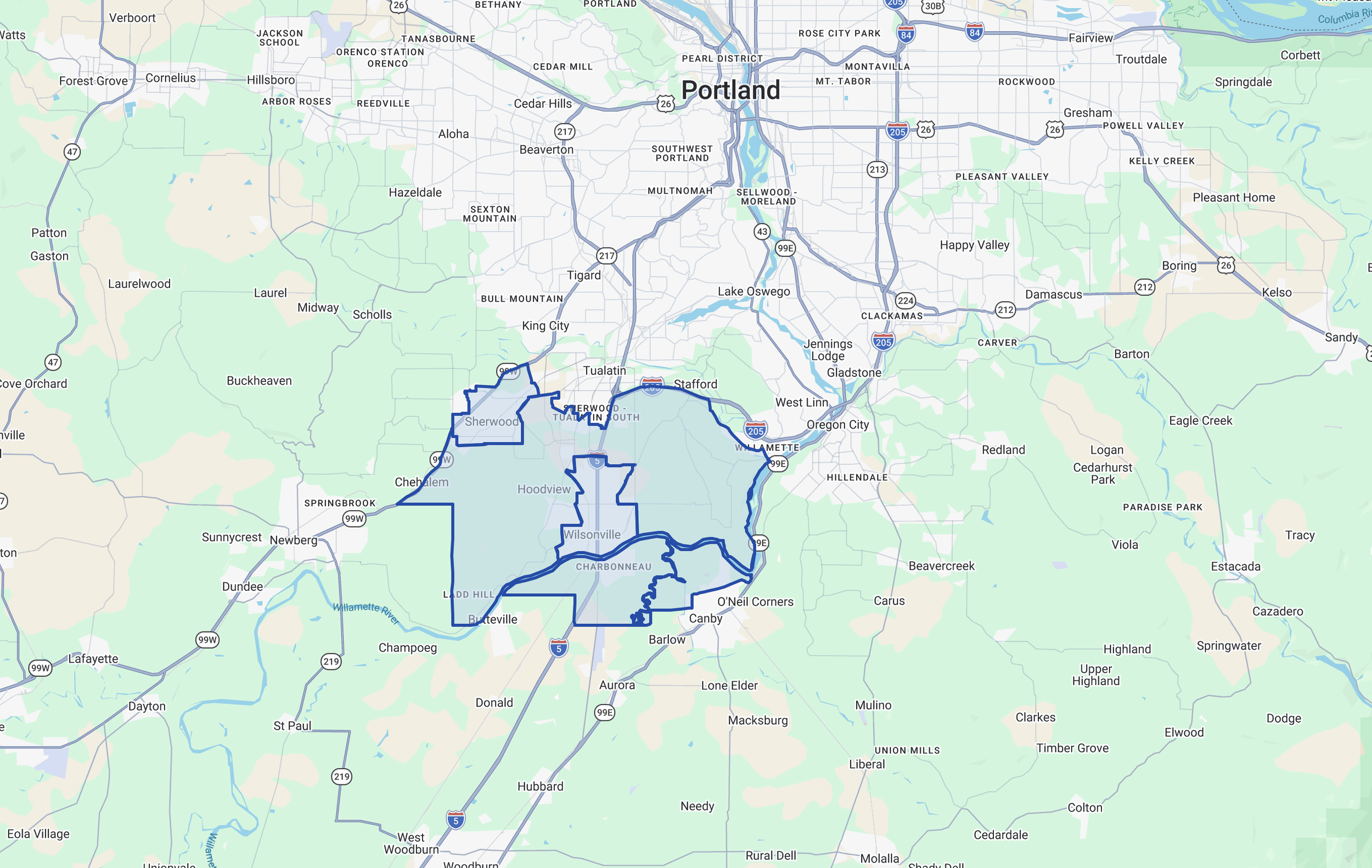

Wilsonville and Sherwood form one of the Portland metro’s most active growth corridors for industrial and distribution space. Located along I-5 south of Portland, this submarket supports regional logistics, manufacturing, and flex industrial users that require modern buildings, truck access, and expansion potential. Compared to Portland’s infill industrial areas, Wilsonville and Sherwood offer newer inventory, larger sites, and more development opportunities.

WHATS DIFFERENT ABOUT THE SUBMARKET

Wilsonville and Sherwood skew more modern, business-park industrial than most Portland submarkets, with a higher share of newer flex/warehouse inventory and larger site layouts. Decisions here are often driven by clear height, dock/grade loading mix, and truck circulation, plus business-park rules around vehicle/trailer staging, outdoor storage, signage, and operating hours. The fastest way to narrow options is to confirm loading/circulation and any park restrictions first, then evaluate parking ratios, power/sprinklers, and expense/maintenance language.

LOCATION INFORMATION

Wilsonville and Sherwood sit in the southwest Portland metro, along the I-5 corridor between Tigard/Tualatin and Salem, with fast access to I-205 via the Wilsonville area and regional routes serving the south metro. Industrial inventory is concentrated around I-5 interchanges and business parks in Wilsonville, with additional light industrial and flex pockets near Sherwood’s edges and the Tualatin/Sherwood boundary. In practice, this submarket serves companies that need south-metro access, truck-friendly circulation, and modern flex/warehouse options without being in the close-in Portland corridors.

QUICK SNAPSHOT

Known For

Modern distribution and warehouse facilities

Newer industrial parks and build-to-suit sites

Large footprints with expansion potential

Manufacturing and production space

Strong I-5 freeway access and logistics positioning

Typical User Profiles

Regional Distributors & Logistics Operators

Manufacturing & Assembly Companies

E-commerce & Fulfillment

Construction & Building Suppliers

Office-Warehouse & Flex Industrial Users

Best Fits

Regional Distribution & Logistics Users:

Manufacturing & Production Companies

Large-Format Warehouse Tenants

E-commerce & Fulfillment Operations

Companies Planning for Expansion or Long-Term Growth

Common Constraints

Limited Small-Bay Inventory — While Wilsonville and Sherwood offer larger modern buildings, smaller units under 10,000 SF can be harder to find and lease quickly when available.

Development Timing & Infrastructure — New projects continue to come online, but site delivery timelines, utilities, and permitting can affect availability for expanding tenants.

Truck & Traffic Planning — Growth along the I-5 corridor has increased truck traffic and commute times during peak hours, making site circulation and freeway proximity important factors.

RENT, PRICING, AND DEAL TERMS

Typical Deal Terms

Wilsonville/Sherwood tends to be newer business-park industrial. Concessions often focus on TI for office finish, delivery condition, and clear rules for vehicle/trailer staging. Since this corridor is chosen for scalability, options and expansion language can be more valuable than squeezing base rent.

Negotiation Levers

Concessions: Free rent and concessions vary by building size and age. Larger blocks and new construction may offer incentives during slower leasing periods, while modern distribution buildings with strong demand often lease with limited concessions.

NNN/CAM language: Most leases are triple-net with tenants responsible for property taxes, insurance, maintenance, and management fees. Newer institutional properties often provide clearer operating expense structures and predictable cost increases.

Expense controls: Controllable CAM caps, base-year structures, and audit rights are more common in newer industrial parks and institutional ownership. Longer lease terms typically improve negotiating leverage.

Comparing Proposals

Industrial proposals in Wilsonville and Sherwood can look similar on base rent but differ significantly in operating costs, improvement allowances, and expansion flexibility. Tenants should compare total occupancy cost, building functionality, and long-term growth potential. Modern buildings may carry higher base rents but often provide operational efficiency, better truck circulation, and lower long-term maintenance risk.

Deal Killers

Business-park rules restrict staging, storage, or operating patterns.

Loading/circulation works for vans but not for true truck patterns.

Parking looks fine until the staffing model + visitors are added.

Mini Case Example

A growing operator targeted modern flex with strong circulation and future growth capacity. Properties were screened by loading/circulation + rules before tours. Negotiations prioritized expansion/renewal protections and documented staging allowances.

SUBMARKET FAQ

-

This corridor tends to fit distribution, light manufacturing, service operations, and flex users who want south-metro access with a more business-park, truck-friendly environment than close-in Portland.

-

Generally, yes. Wilsonville has the larger concentration of modern industrial and flex inventory clustered near I-5 interchanges and business parks. Sherwood has smaller flex/industrial pockets, often closer to the Tualatin/Sherwood boundary.

-

Modern flex and warehouse product is common in Wilsonville, often with higher office finish levels than functional close-in industrial. Loading varies by asset—confirm dock vs grade, door counts, and circulation early.

-

Very. Many sites are designed around business-park circulation rules and specific delivery patterns. Confirm turning, staging, delivery hours, and any restrictions that could impact operations.

-

Sometimes, but it’s not automatic. Trailer/van parking policies vary widely by property and park rules. Confirm what’s permitted, where it can occur, and whether it’s exclusive.

-

Loading configuration (dock/grade), clear height (if relevant), power availability, sprinkler adequacy, parking ratio, and any restrictions on outdoor storage, fleet vehicles, or after-hours operations.

-

Pricing is often driven by newer construction, office finish levels, and site utility (parking/circulation). Effective economics can change materially based on concessions, operating expenses, and maintenance responsibility.

-

Typically 12–18 months before lease expiration, earlier if the space is customized, equipment-heavy, or if the operation needs special loading/parking allowances.

-

Most late issues come from use restrictions, vehicle/trailer parking rules, unclear maintenance scope, or mismatched loading/circulation—items that are often glossed over until after the LOI.

RELATED

GET IN TOUCH

Contact Matt Lyman at Norris & Stevens about any Portland commercial real estate need—leasing, renewals, relocations, site selection, lease-up strategy, tenant/landlord representation, acquisitions, dispositions, or a quick market opinion.

Share your property type, size, location/submarket, timing, and what decision you’re trying to make, and Matt will follow up with clear next steps and relevant market context.

Coverage includes industrial, office, retail, and flex across the Portland metro—217 Corridor (Beaverton/Tigard/Tualatin), Central Eastside, Airport Way/Columbia Corridor, Clackamas, and Vancouver, WA.